Upon reaching 60 all savings will be consolidated into this. EPF Withdrawals for Housing.

Epf Withdrawal Rules 2022 Medical Emergency Home Loan And Retirement Eligibility How To Withdrawal Pf Online And Offline

The special age 55 withdrawal provision doesnt apply if you leave your previous employer before you reach age 55 or age 50 for public safety employees even if youre over age 55 now.

. FIle pic by AMIR IRSYAD OMAR. Takes note of the World Banks suggestion to gradually raise the age when members can make full withdrawal of Accounts 1 and 2 of their EPF retirement savings from 55 to 65. KUALA LUMPUR May 4 The Employees Provident Fund EPF will be resuming Age 505560 Withdrawals and mobile i-Akaun activation services beginning Wednesday May 6 at approved branches throughout the country.

You can make a one-time withdrawal of all or part of your savings in EPF Account 2 when you reach age 50. I want to assure the rakyat that EPF members will retain their right to withdraw at the age of 55 he said during his keynote address at Invest Malaysia 2015 in Kuala Lumpur this morning. Members cannot access savings in Akaun Emas until they reach age 60.

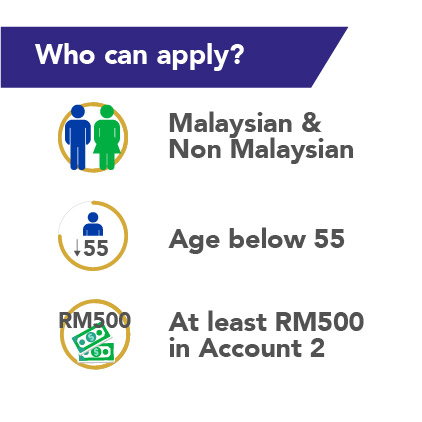

KUALA LUMPUR The application for Employees Provident Funds EPF RM10000 withdrawal will be opened to members below age 55 between April 1 and 30. You will not be able to choose the account from which to withdraw your monies when you make a withdrawal after age 55. The government is not implementing the Employees Provident Fund EPF withdrawal at age 60 for private sector employees although the minimum retirement age has been extended to 60 years effective.

Aged between 50 and before reaching the age of 55. Monday 04 May 2020 1000 AM MYT. But if you contribute between year 55-59 you can only withdraw back that amount in year 60 Quote from EPF - Upon reaching age 55 the contributions made to your Account 1 and Account 2 will be consolidated into Account 55.

The EPF however said it has taken note of the World Banks suggestion to gradually raise the age when members can make a full. Refer to the list of EPF panel banks for direct. You can withdraw all or part of the savings from this account at any time.

You can self contribute up to 60K a year. Have savings in Account 2. After leaving a job a person can withdraw 75 of the provident fund balance if he remains unemployed for 1 month and the remaining 25 after the second month of unemployment.

Among the initiatives is to raise the EPF full withdrawal to 60 from the current 55 years old. Personally I want EPF full withdrawal age to stay at 55 instead of 60 years old. The EPF assures members that no such steps on raising the withdrawal age have been discussed with any party at this point in time.

A member who joins the Employees Pension Scheme 1995 at the age of 23 and superannuates at the age of 58 and contributing to the present wage ceiling of Rs15000- may get about Rs7500- as pension if service is 35 years. Members who have not set aside the FRS can still withdraw. To facilitate EPF Members in preparing for a comfortable retirement the EPF allows you to make a partial or full withdrawal from your savings to meet the specific retirement-related needs that are in line with the EPFs current policies.

Now you can withdraw all your EPF at age 55 while you are still working with someone else if you choose to retire at later years say at age 60. What You Can Withdraw. This is an account for EPF members who continue to work beyond the age of 55.

Withdrawal from Akaun 55. Withdraw via i-Akaun plan ahead for your retirement. FULL WITHDRAWAL AT AGE 55 REMAINS.

Withdrawal from both Account 55 and. 7 rows About Age 55 Withdrawal. Upon reaching age 55 the contributions made to your Account 1.

Upon turning age 55 CPF members can withdraw their CPF savings after setting aside their. In August 2015 the hot topics for many Malaysian are on the Enhancement Initiatives of EPF Scheme. KUALA LUMPUR June 26 The Employees Provident Fund EPF today assured members that the issue of raising the withdrawal age has not been discussed with any party at this point in time.

The EPF however said it has taken note of the World Banks suggestion to gradually raise the age when members can make a full withdrawal of Accounts One and Two. 8 rows The EPF assures members that the current Age 55 Withdrawal will. About 4 in 10 did not make withdrawals after turning 55 years old.

Here are the main amendments to EPF withdrawal rules 90 of the EPF balance can be withdrawn after the age of 54 years. EPF Full Withdrawal Age Stays at 55. EPF Withdrawals for.

When you reach a certain age the EPF allows. From Jan 2018 EPF members aged 55 60 can withdraw any amount any time. For members turning age 55 for the period of 2017 to 2020 the BRS will be increased by 3 from the previous year.

Monthly contributions between the age of 55 60 will be allocated under this account. In a brief statement EPF said payments for the withdrawals will commence before April 20. Full Retirement Sum FRS equivalent to 2 times BRS.

Basic Retirement Sum BRS with sufficient charge or pledge in their Retirement Account RA OR. This is the most common form of EPF withdrawal. The retirement fund said the services can be done at branches located within states that are.

Members are allowed to withdraw a maximum amount of RM10000 and minimum RM50 and must fully. Pensionable Salary X Pensionable Service70 15000x3570 7500. The EPF will ensure that any new enhancement will only apply to new contributions if members decide to work beyond the age of 55.

Entire savings in Account 2. The Employees Provident Fund EPF today assured members that the issue of raising the withdrawal age has not been discussed with any party at this point in time. Any withdrawals you take are subject to the penalty tax unless you can roll your 401k plan to an IRA and qualify for an exception to the penalty.

Full withdrawal at age 55 remains Malay MailKUALA LUMPUR June 26 The Employees Provident Fund EPF says it has taken note of the World Bank s suggestion to gradually raise the age when members can make a full withdrawal of Accounts One and Two of their EPF retirement savings from 55 to 65. Paying for immediate expenditure needs. What are the EPF withdrawal rules.

When you reach a certain age owning your own home will be high on your list of things to. Left in savings accounts of financial institutions with no specific use. After members reach age 55 and have set aside the Full Retirement Sum FRS they will be able to withdraw the remaining balances from their Special Account SA first and then Ordinary Account OA.

For those who did withdraw from their CPF between 55 to 70 years old the funds were mainly used for. The Employees Provident Fund EPF members aged 55 and 60 can now make partial withdrawals of any amount at any time from next January. Full withdrawal at age 55 remains.

But savings under Akaun 55 will still be accessible to members. Big-ticket items such as holidays or home renovations 4 in 10 Did Not Make.

4 Epf Withdrawal Changes Effective From Feb 2016

Epf Now Lets You Invest In Unit Trust Funds Directly Via I Akaun Portal Soyacincau

Pros And Cons Of Later Epf Withdrawal Visual Ly

Average Savings Of Epf Members At 54 Years Of Age Download Table

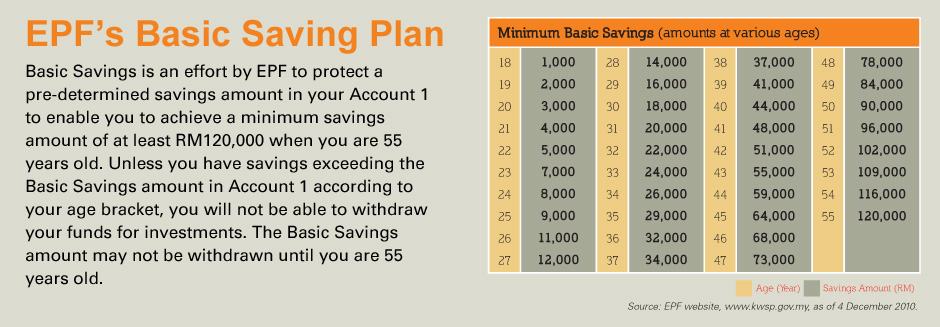

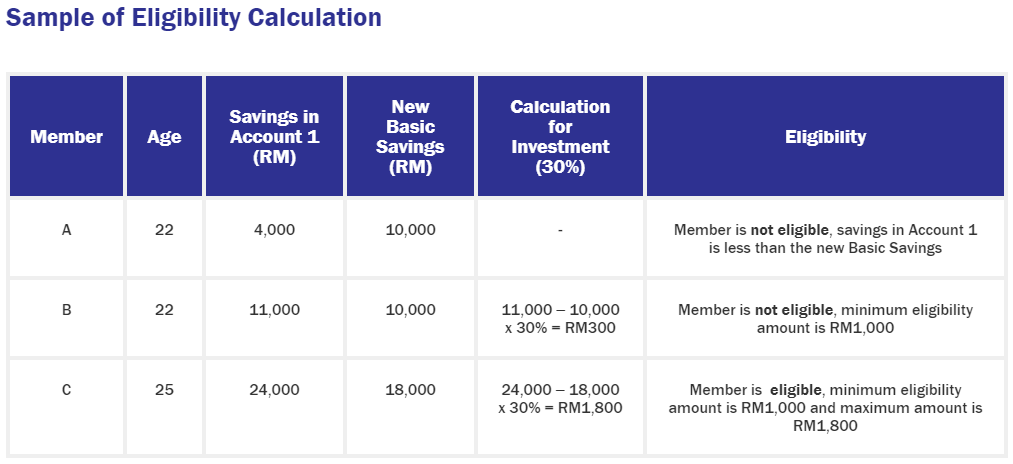

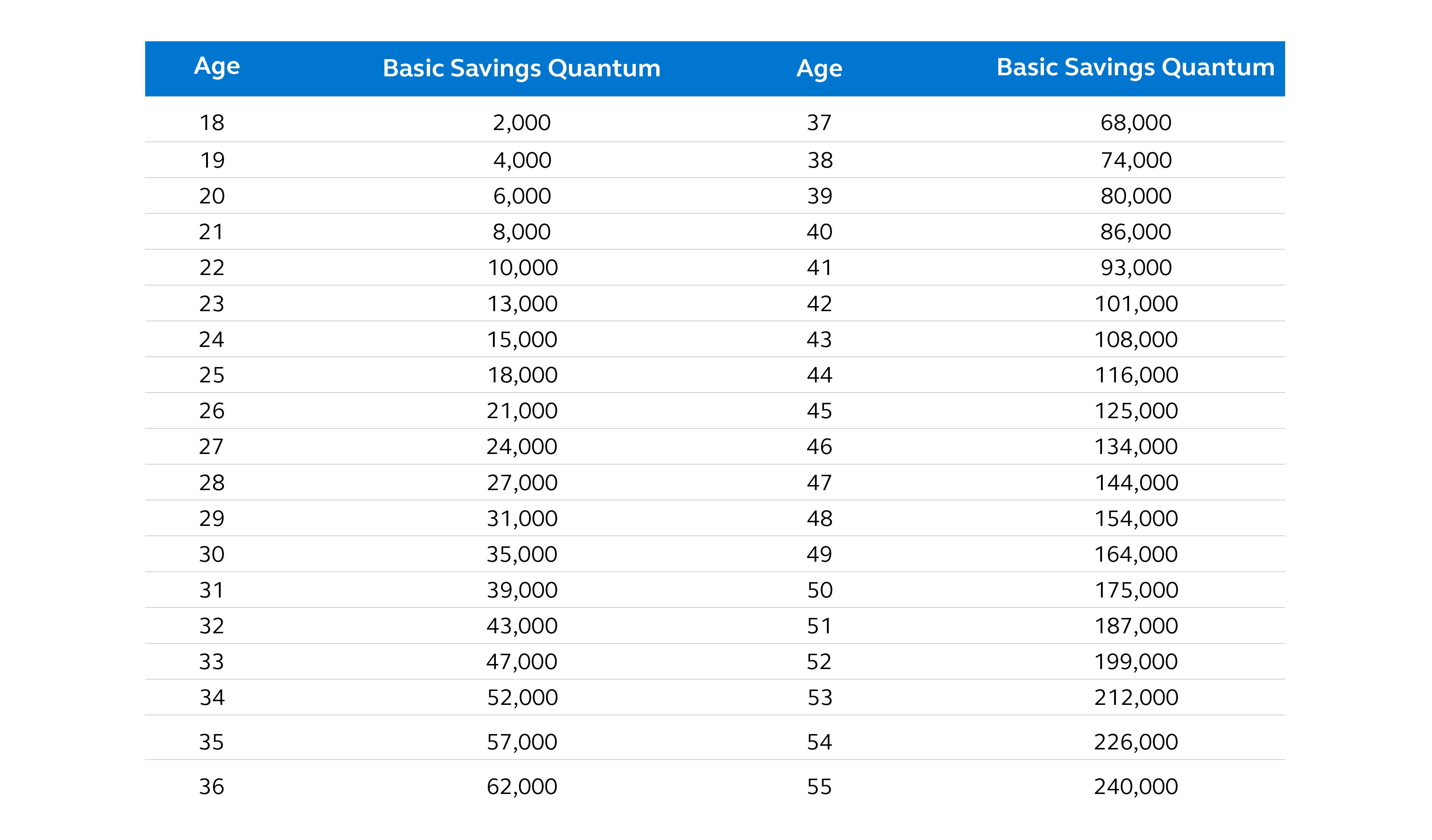

What Is The Ideal Savings According To Age Bracket Principal Asset Management

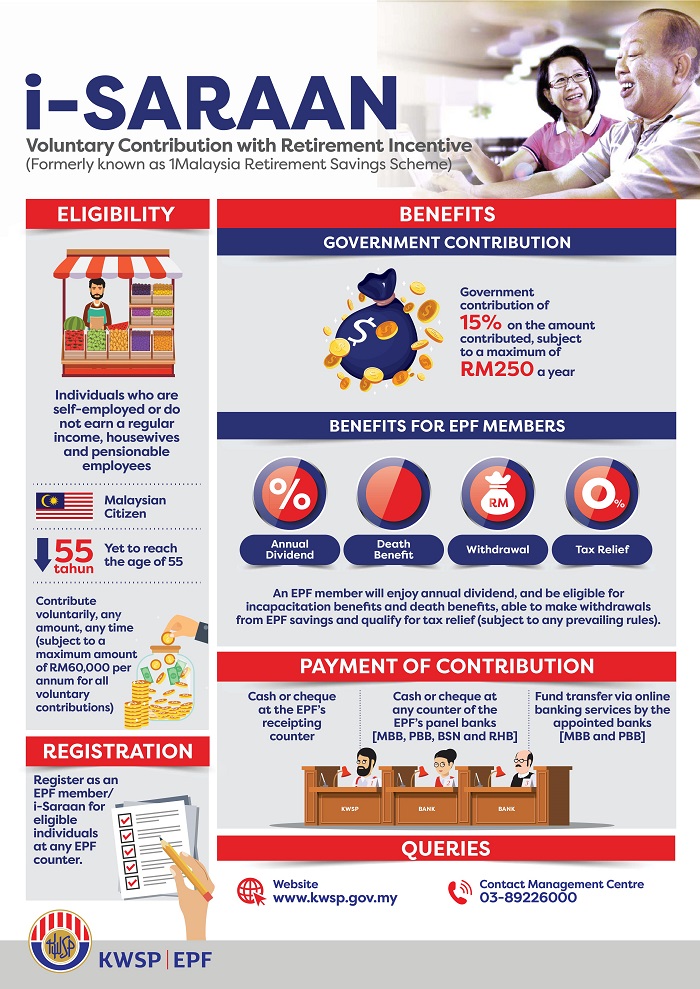

What You Need To Know About Epf S I Saraan

Pm Ismail Sabri Malaysians Can Withdraw Rm10 000 From Epf

New Akaun Emas To Lock In Savings Until Contributor Turns 60

Epf Introduces Akaun Emas For Withdrawal At Age 60 The Edge Markets

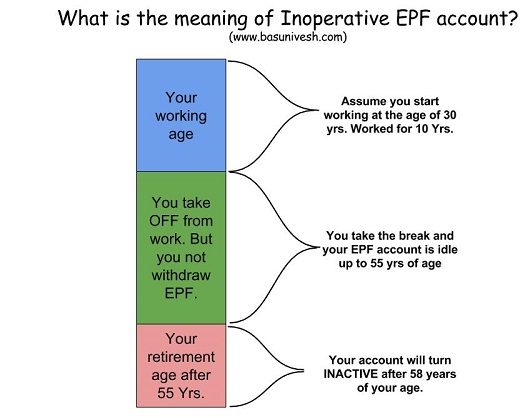

Interest On Inoperative Epf Accounts Up To 58 Yrs Of Age Basunivesh

Full Epf Withdrawal Not Allowed 4 New Changes Of Epf Withdrawal

Epf Withdrawal Only For Members Below Age 55 Payment From April 20

Ilyf Personalised Insurance For Drivers Ready To Save Up For Your Retirement In Malaysia The Two Main Retirement Channels Are Epf Prs In Our Latest Article We Ve Provided In

Why Should You Withdraw Old Epf Account Balance

How To Own A New Home Through Withdrawal From Kwsp Account 2 Kinta Properties

Why Should You Withdraw Old Epf Account Balance

Withdraw All Your Epf At Age 55 While Still Working Until 60 Tax Updates Budget Business News